New Jersey Digs the Fiscal Hole Deeper

Governor Phil Murphy recently signed New Jersey’s Fiscal Year 2021 budget. Rather than tightening the belt and reining in debt and spending, the Garden State implemented a massive tax increase and took on an additional $4.5 billion in debt. State Senator Steve Oroho and State Assemblymen Hal Wirths and Parker Space called the budget passage a “costly day for every New Jersey resident.”

Unfortunately, new taxes will continue to drive residents to “vote with their feet” out of New Jersey, a state that has suffered a net loss of more than 500,000 residents to other states over the past decade alone.

In the fiscal year 2021 budget, New Jersey enacted several major tax increases:

- An income tax increase that raises the state’s top marginal income tax rate to 10.75%, an increase of nearly 20% from a revenue source that’s proven to be highly volatile.

- An extension of the 2.5% surtax on the corporate business tax for corporations with taxable net income in excess of $1 million through 2021. This tax was originally planned to be phased out but will be kept in place. This will put added stress on small businesses in New Jersey, making it one of the highest business taxes in the country.

- A gas tax hike from 41.4 to 50.7 cents per gallon of gasoline (48.4 to 57.7 cents per gallon of diesel), making it the fourth highest gas tax in the nation.

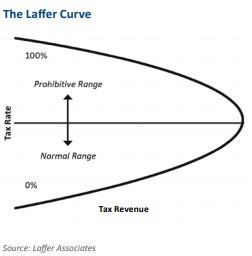

An important economic insight for anyone in policy and government is that taxes harm economic growth and therefore reduce revenue collections from expectations due to the change in the behavior of individuals – such as the 500,000 who have left New Jersey over the last decade. This insight was made famous by Dr. Arthur B. Laffer and is illustrated in the graph below. The Laffer Curve demonstrates that at a certain point, tax rates become prohibitive and affect the behavior of businesses and individuals.

For the Garden State, these indicators are highlighted in the ALEC annual report Rich States, Poor States. In the latest edition of the report, New Jersey ranked 48th in economic outlook and 45th in economic performance. During the pre-COVID economic expansion nationally, New Jersey had some of the highest tax rates in the country, low GDP growth (43rd in the nation), high net-outmigration, and low employment growth.

Additionally, New Jersey has over $196 billion in unfunded pension liabilities, over $130 billion in unfunded OPEB liabilities, and over $66 billion in bonded obligations. In total, that’s almost $394 billion in debt, over $22,000 per capita (more than double the cost of a full year at Rutgers University for a New Jersey resident). All this debt translates into future tax hikes.

This was all before New Jersey passed their FY 2021 budget that increased tax burdens and added $4.5 billion in new debt. Using the Rich States, Poor States “Adjust Policies” tool, New Jersey’s Economic Outlook would drop to 49th in the country as a result of the new budget.

Last year, there was a discussion by some in New Jersey to reform the state’s pension and OPEB systems, but even the proposal to simply create a fiscal review commission was vetoed by the governor. New Jersey needs serious tax and fiscal reforms that reverse uncompetitive policies and the economic harm they have caused. Unfortunately, as Assemblyman Hal Wirths put it, “with $703 million of increased taxes, $1.7 billion of spending hikes and $4.5 billion of new borrowing, this budget does less for more.”